The shipments element of the Cass Freight Index elevated by 7.3% m/m in February, impacted by climate impacts on freight markets and a Leap Day, the principle issue behind the two.0% m/m improve in seasonally adjusted (SA) phrases. In comparison with final yr, the index was 4.5% decrease, and the smallest decline in ten months, based on Tim Denoyer from ACT Analysis.

Get the clearest, most correct view of the truckload market with information from DAT iQ.

Tune into DAT iQ Dwell, reside on YouTube or LinkedIn, 10am ET each Tuesday.

Denoyer famous, “February introduced extra encouraging indicators {that a} freight restoration is starting. Cargo volumes had been barely forward of m/m seasonal expectations, and whereas they remained decrease than final yr, the hole continues to shut. With regular seasonality, shipments might be down simply -1% y/y in March and switch optimistic y/y in Might. It’s been over two years for the reason that first y/y decline of this freight recession, and with destocking taking part in out and items consumption rising, we see this enchancment as an encouraging signal {that a} restoration is starting.”

Market watch

All charges cited beneath exclude gasoline surcharges except in any other case famous.

Despite the fact that the amount of outbound masses in Texas decreased by 5% final week, linehaul charges elevated by $0.04/mile to a state common of $1.56/mile, making it the fifth week of successive features. The Dallas/Ft Price metroplex reported strong features, with spot charges up 2% week-over-week (w/w) to $1.43/mile. Laredo, the biggest industrial truck crossing zone for masses from Mexico, reported a 6% w/w lower in masses moved whereas obtainable capability tightened with spot charges growing by $0.05/mile to $1.78/mile.

In California, state common charges elevated by $0.04/mile to $1.86/mile for outbound masses. Linehaul charges within the state have risen for the previous 4 weeks and at the moment are 8% greater than final yr. On the high-volume lane east to Phoenix, Los Angeles dry van carriers had been paid a median of $2.55/mile following final week’s $0.05/mile improve on an 11% decrease quantity of masses moved.

Load-to-Truck Ratio

Dry van load submit quantity decreased by 2% final week however was up 15% month-over-month (m/m) and three% year-over-year (y/y). Obtainable capability decreased following final week’s 4% drop in gear posts, growing the load-to-truck ratio by 2% to three.28.

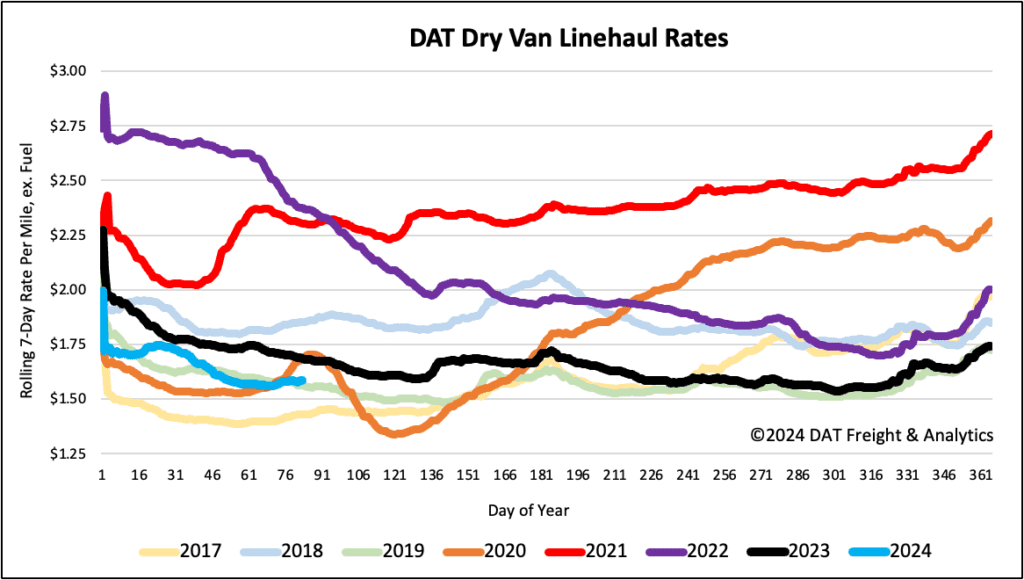

Linehaul spot charges

After being flat for the previous month, dry van linehaul charges elevated by $0.01/mile, the primary weekly achieve since mid-January’s nationwide freeze. At $1.59/mile, dry van linehaul charges are $0.10/mile decrease than final yr. Primarily based on the amount of masses moved DAT’s High 50 lanes averaged $1.87/mile final week, sustaining the $0.28/mile unfold above the nationwide common.

Weekly stories

-

-

- Dry van

- Reefer

- Flatbed

-

The submit Dry van report: Shipments plunge, however the worst may very well be over appeared first on DAT Freight & Analytics – Weblog.